And for luxury brands, this window is even more nuanced. Unlike mainstream retailers, most luxury players do not rely on steep Black Friday or Cyber Monday discounts to capture attention. So how do they stay relevant when consumers are flooded with promotions?

To remain top-of-mind, luxury brands need to anticipate when their audience is most likely to engage - and that requires more than intuition. It’s about leveraging data to uncover subtle shifts in consumer behavior and using those insights to plan campaigns that resonate at the right moment. By grounding strategy in evidence rather than guesswork, brands can maintain relevance even in the most crowded holiday landscape.

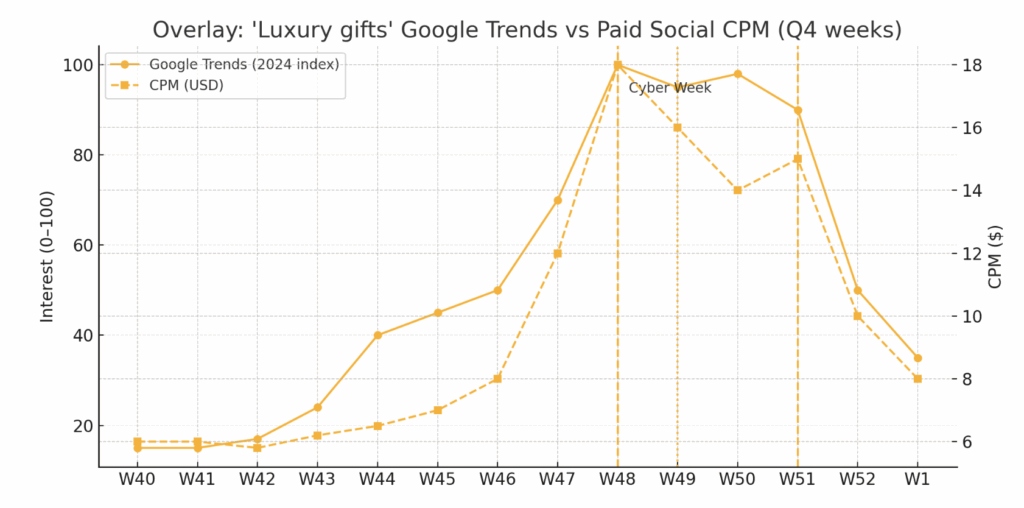

At Code3, we analyzed three years of Google Trends data for “luxury gifts” and overlaid it with paid social cost patterns from our retail and fashion pod. The results highlight when luxury brands should ramp up investment and how to approach their holiday paid social strategy with precision.

Key Insights

Demand Build Begins Late October

Week 43 (Oct 21–27) marks the start of a climb in clicks, accelerating into Week 44 (Oct 28–Nov 3). This aligns with Google Trends, which shows luxury gift searches picking up in the last week of October. The good news is CPM remains low through October, making it an ideal time to build awareness and fill the funnel efficiently before competition spikes.

Sweet Spot for Scaled Investment

The right time to make a strategic shift are weeks 47–49 (Nov 18–Dec 8), which are the prime window for capturing demand. Clicks peak in Week 49 (Dec 2–8), while CPC is elevated but not at its highest. Google Trends confirms this pattern, with “luxury gifts” searches peaking in Week 48 and holding strong into Week 49. During this time, CTR begins to rebound after its October dip, suggesting shoppers are more engaged and ready to click.

Efficiency and Cost Dynamics

Moving into Cyber Week, competition begins to intensify. CPM spikes sharply beginning in Week 47, peaking in Week 48 (Cyber Week). CTR bottoms out in early November but rises steadily into December, signaling stronger conversion intent closer to the holidays.

Post-Holiday Opportunity

Late December brings the last-minute gift buyers, and Week 51 (Dec 16–22) delivers strong clicks and CTR despite high CPM. Post-holiday, Weeks 52–1 (Dec 23–Jan 5) show a natural drop, but remain useful for loyalty-building, self-gifting (ie gift card purchasers) and New Year refresh messaging.

Recommended Holiday Strategy

Q4 performance hinges on timing, and the data makes it clear that not all weeks carry the same weight. Google Trends and paid social cost patterns show distinct shifts in consumer behavior, from efficient reach opportunities in late October to peak engagement and conversion moments in late November and early December. By aligning media investments with these data-backed inflection points, luxury brands can maximize efficiency, protect ROAS during high-cost periods, and ensure messaging resonates with the right audience at the right time.

To maximize Q4 performance, luxury brands should align media investments to each stage of the funnel:

- Upper Funnel (Oct 21 – Nov 10, Weeks 43–45): Build awareness with brand storytelling and gift guides. CPMs are low, offering efficient reach to seed consideration.

- Mid Funnel (Nov 11 – Nov 24, Weeks 46–47): Shift focus to retargeting. Re-engage audiences who interacted in October/early November with curated gift sets and efficiency messaging.

- Lower Funnel / Conversion (Nov 25 – Dec 15, Weeks 48–50): Go heavy during Cyber Week and the first two weeks of December. This is the prime conversion period. Use urgency-driven messaging around shipping deadlines or limited editions.

- Last-Minute Buyers (Dec 16 – Dec 22, Week 51): Use this period to reinforce shipping cut-offs and fulfillment options so shoppers feel confident their gifts will arrive on time. Highlight premium services such as white-glove delivery, in-store pickup, or guaranteed holiday arrival. As the window for gifting closes, pivot messaging toward self-gifting. Position key products and signature collections as the perfect way to reward oneself at the end of the season.

- Post-Holiday (Dec 23 – Jan 5, Weeks 52–1): With traditional gifting behind them, many consumers turn to luxury for self-expression and personal reward. Reframe messaging around self-gifting, starting the new year with intention, and refreshing one’s collection. Keep spend lighter, but maintain presence with campaigns that emphasize loyalty, timeless pieces, and year-round value.

Strategic Takeaways

Luxury brands should front-load awareness in late October and early November, taking advantage of lower CPMs before the holiday rush. The heaviest investment should then be concentrated between November 18 and December 8, when consumer demand and click-through rates are at their peak. During Cyber Week, CPMs tend to spike, making agility and daily optimization critical to protecting ROAS.

Creative sequencing also plays a key role: beginning with storytelling, moving into gift guides, then urgency messaging, and finally, last-minute solutions. To maximize impact, campaign tactics should align closely with search intent, matching the rhythm of peak luxury gifting moments across Cyber Week, early December surges, and the final days before shipping cut-offs.

For luxury brands, staying relevant without heavy discounting comes down to timing, storytelling, and precision. By aligning spend with consumer intent and carefully sequencing creative, brands can maximize Q4 performance while protecting brand equity.